Source of graph: online version of the WSJ article quoted and cited below.

Source of graph: online version of the WSJ article quoted and cited below.

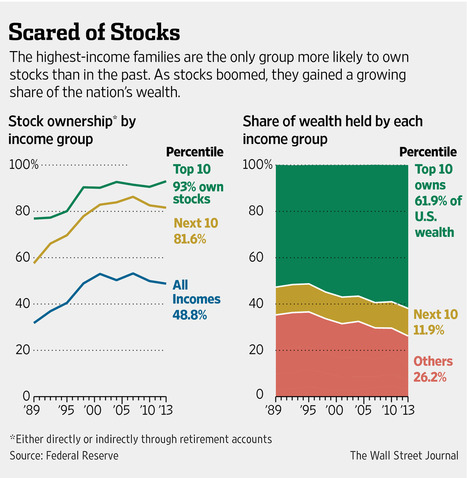

(p. A2) Millions of Americans inadvertently made a classic investment mistake that contributed to today’s widening economic inequality: They bought high and sold low.

. . .

. . . the data suggest some investors simply sold at the wrong moment. “Even at the worst of the recession, most people still had jobs,” said Mr. Maki. “Certainly, some of the people who got out of the equity market were doing it because of fear rather than need.”

That’s also the finding of new research from economists Bing Chen and Frank Stafford at the University of Michigan. They plumbed the Panel Study of Income Dynamics, a survey that tracks the same households over time, to evaluate the factors behind their fluctuating incomes and wealth.

Households with the highest education and strong portfolios to begin with were likely to keep buying stocks during the decline, they found. Those with less education and smaller account balances were more likely to sell during the downturn.

When the subsequent rebound happened, the already rich got even richer.

. . .

“. . . there certainly is a widening gap there in terms of the return that higher-income people are receiving in the market,” said Mr. Akabas [an economist at the Bipartisan Policy Center in Washington who works on the center’s Personal Savings Initiative]. “Lower- to middle-income people aren’t privy to those gains. That’s exacerbated by the fact that many of them have taken their money out of the stock market.”

For the full commentary, see:

JOSH ZUMBRUN. “THE OUTLOOK; Market Missteps Fuel Inequality.” The Wall Street Journal (Mon., Oct. 27, 2014): A2.

(Note: ellipses, and bracketed words, added.)

(Note: the online version of the commentary has the date Oct. 26, 2014, and has the title “THE OUTLOOK; Bad Stock-Market Timing Fueled Wealth Disparity.”)