BALTIMORE — In Big Labor’s war against Wal-Mart, "collateral damage" — in the form of lost jobs and income for the poor — is starting to add up. Of course, since the unions and their legislative allies claim that their motive is to liberate people from exploitation by Wal-Mart, these unintended effects are often ignored.

Here in Maryland, however, that’s getting hard to do. The consequences of our legislature’s override of Republican Gov. Robert Ehrlich’s veto of their "Fair Share Health Care Act" on Jan. 12 will be tragic for some of the state’s neediest residents. The law will force companies that employ over 10,000 to spend at least 8% of their payroll on health care or kick any shortfall into a special state fund. Wal-Mart would be the only employer in the state to be affected.

Almost surely, therefore, the company will pull the plug on plans to build a distribution center that would have employed 800 in Somerset County, on Maryland’s picturesque Eastern Shore. As a Wal-Mart spokesman has put it, "you have to take a step back and call into question how business-friendly is a state like Maryland when they pass a bill that . . . takes a swipe at one company that provides 15,000 jobs."

. . .

. . . , legislators should be mindful that companies like Wal-Mart are not the enemy but rather front-line soldiers in a real war on poverty. The profit motive leads them to seek out areas where there is much idle labor and put it to work. Where they are prevented or discouraged from doing so, the alternative job prospect is rarely a cushy spot in the bureaucracy. Rather, it is continued idleness and hardship.

For the full commentary, see:

STEVE H. HANKE and STEPHEN J.K. WALTERS. "Cross Country; Hard Line State." The Wall Street Journal (Thurs., January 26, 2006): A11.

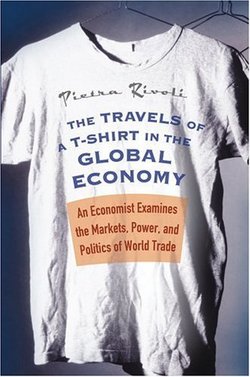

Image source:

Image source: