The strong bipartisan support for increasing the federal minimum wage to $7.25 an hour from the current $5.15 — a 40% increase — is a sad example of how interest-group politics and the public’s ignorance of economics can combine to give us laws that manage to be both inefficient and inegalitarian.

An increase in the minimum wage raises the costs of fast foods and other goods produced with large inputs of unskilled labor. Producers adjust both by substituting capital inputs and/or high-skilled labor for minimum-wage workers and, because the substitutes are more costly (otherwise the substitutions would have been made already), by raising prices. The higher prices reduce the producers’ output and thus their demand for labor. The adjustments to the hike in the minimum wage are inefficient because they are motivated not by a higher real cost of low-skilled labor but by a government-mandated increase in the price of that labor. That increase has the same misallocative effect as monopoly pricing.

Although some workers benefit — those who were paid the old minimum wage but are worth the new, higher one to the employers — others are pushed into unemployment, the underground economy or crime. The losers are therefore likely to lose more than the gainers gain; they are also likely to be poorer people. And poor families are disproportionately hurt by the rise in the price of fast foods and other goods produced with low-skilled labor because these families spend a relatively large fraction of their incomes on such goods. And many, maybe most, of the gainers from a higher minimum wage are not poor. Most minimum-wage workers are part time, and for the majority their minimum-wage income supplements an income derived from other sources. Examples are retirees living on Social Security or private pensions who want to get out of the house part of the day and earn pin money, stay-at-home spouses who want to supplement their spouse’s earnings, and teenagers working after school. An increase in the minimum wage will thus provide a windfall to many workers who are not poor.

Some economists deny that a minimum wage reduces employment, though most disagree. And because most increases in the minimum wage have been slight, their effects are difficult to disentangle from other factors that affect employment. But a 40% increase would be too large to have no employment effect; about a tenth of the work force makes less than $7.25 an hour. Even defenders of minimum-wage laws must believe that beyond some point a higher minimum would cause unemployment. Otherwise why don’t they propose $10, or $15, or an even higher figure?

A number of countries, including France, have conducted such experiments; the ratio of the minimum wage to the average wage is much higher in these countries than in the U.S. Economists Guy Laroque and Bernard Salanie find that the high minimum wage in France explains a significant part of the low employment rate of married women. Mr. Salanie has argued that the minimum wage also contributes to the dismal employment prospects of young persons in France, including Muslim youths, an estimated 40% of whom are unemployed.

For the full commentary, see:

Why is this man smiling? (Alan Greenspan has reason to grin.) Source of photo: online version of the NYT article cited below.

Why is this man smiling? (Alan Greenspan has reason to grin.) Source of photo: online version of the NYT article cited below.

Dr. John Snow. Source of photo: online version of the WSJ article cited above.

Dr. John Snow. Source of photo: online version of the WSJ article cited above. Edwin Chadwick. Source of photo: online version of the WSJ article cited above.

Edwin Chadwick. Source of photo: online version of the WSJ article cited above. Source of graph: online version of NYT article cited below.

Source of graph: online version of NYT article cited below.

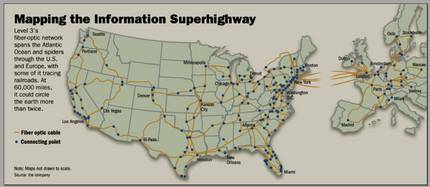

Level 3 stock prices. Source of graphic: online version of the WSJ article cited below.

Level 3 stock prices. Source of graphic: online version of the WSJ article cited below.

Source of book image: the web site cited below.

Source of book image: the web site cited below.

William B. Dunavant, Jr. Source of photo: online version of the NYT article cited above.

William B. Dunavant, Jr. Source of photo: online version of the NYT article cited above.