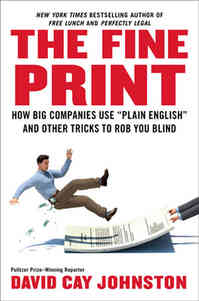

Source of book image: http://www.anderson.ucla.edu/faculty/edward.leamer/images/COVER%209120_jkt_Rev1.jpg

(p. 190) When I was a younger man, I and all of my cohort were apprehensive if we saw Ed Leamer in the audience when we were presenting a paper. His comments were blunt, incisive, and often negative. But what truly terrified us was that he was almost always right. . . .

Leamer has produced a highly original little book, with big insights and lessons for us all. He explores the tension between economics that is mathematically sophisticated and complex but often vacuous, versus economics that may be vague but which is useful and carries a message. It is frankly a remarkable work, full of insights and persuasive arguments that need to be read, debated, and taken seriously.

. . .

(p. 191) But this is no rant of an old guy. Leamer gets very specific about his notions of usefulness versus rigor. A good drum to bang on is Samuelson, an important “mathematizer.” I would strongly encourage all young trade economists and perhaps all graduate students who have been subjected to a traditional international trade course at any level, to read the section on factor-price equalization. This is beautifully done and even exciting and funny at times. As told by Leamer, the young Samuelson excoriates Ohlin for largely dismissing the possibility of factor-price equalization and then presents his (Samuelson’s) “proof” of factor-price equalization. The latter, of course, is a theorem that is mathematically correct given the assumptions, but Ohlin is talking about its usefulness in understanding the world and constructing policy. The factor-price-equalization theorem is indeed a prime example of something that is valid but not useful.

. . .

Yet at the same time, I have thought long and hard about exactly what message should be given to graduate students and assistant professors without much success. The journal publishing business puts a huge premium on rigor over usefulness and few referees or editors are inclined to take the chance inherent in accepting papers that are a bit loose in their analytical or econometric structures, no matter how exciting they might be. If you accept that, then the profession as a whole has to rethink our view of what is an important scientific contribution: I cannot simply tell graduate students to think more broadly and worry less about elegance. Some will of course deny that there is any tension, but I side with Leamer. Over and over again, I hear, read, and/or referee papers (p. 192) where, in order to get an analytical solution to a model, the author has to assume away almost every interesting feature of the problem to the point that the remaining model is uninteresting and uninformative. But that at least qualifies the paper for possible publication in Econometrica, RESTud, or JET.

For the full review, see:

Markusen, James R. “Book Review of Ed Leamer’s the Craft of Economics.” Journal of Economic Literature 51, no. 1 (2013): 190-92.

(Note: ellipses added; italics in original.)

The book under review is:

Leamer, Edward E. The Craft of Economics, Ohlin Lectures. Cambridge, MA: The MIT Press, 2012.