Rosenberg and Birdzell (1986) mention that Marx over-emphasized the centrality of factories to capitalism, because of the prominence of factories in the period of capitalism during Marx’s adulthood. They suggest that factories are only one phase, albeit an important one, in the development of capitalism.

And Schumpeter and Rosenberg may have done the same in his believe that large corporate labs would be able to routinize innovative entrepreneurial activity.

One relevant passage:

It is understandable that Marx, writing in 1848, should speak of modern industry as already a century old, for many of the institutions of industry in 1848 were already that old. Yet the greatest advances in the output of the capitalist engine of production, and the greatest changes in its modes of organization, still lay ahead. (1986, p. 184.)

Also relevant is the earlier:

In all Western countries, the inventory of physical facilities for economic production changes. The inventory at any given moment is unquestionably important, but it is like a single frame of a movie; taken alone, it misses all the action, and it is the action that we need to understand and that holds the promise of economic advance to non-Western countries. (1986, p. 144.)

Source:

Rosenberg, Nathan, and L.E. Birdzell, Jr. How the West Grew Rich: The Economic Transformation of the Industrial World. New York: Basic Books, 1986.

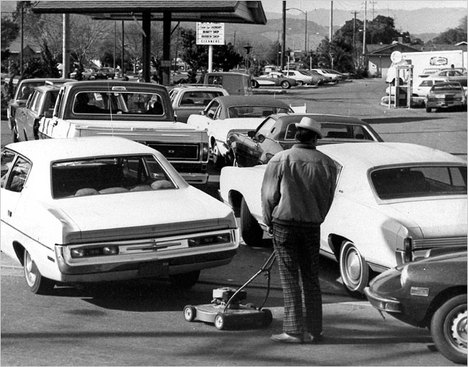

“Arjun Murti at Goldman Sachs studied the 1970s’ oil spikes. One had drivers lined up at a gas station in San Jose, Calif., in 1974.” Source of caption and photo: online version of the NYT article cited below.

“Arjun Murti at Goldman Sachs studied the 1970s’ oil spikes. One had drivers lined up at a gas station in San Jose, Calif., in 1974.” Source of caption and photo: online version of the NYT article cited below.