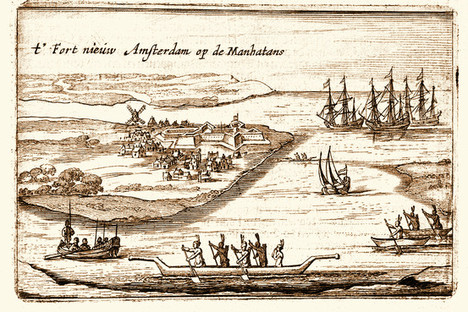

“Print of New Amsterdam by Joost Hartgers, 1626.” Source of caption and image: online version of the WSJ article quoted and cited below.

“Print of New Amsterdam by Joost Hartgers, 1626.” Source of caption and image: online version of the WSJ article quoted and cited below.

(p. A15) The financial collapse of 2008 and the Great Recession have had, not surprisingly, a major adverse impact on the economy of the country’s financial center, New York City. There have been over 40,000 job losses in the financial community alone and both city and state budgets are deeply dependent on tax revenues from this one industry. There has been much talk that New York might take years to recover–if, indeed, it ever can.

But if one looks at the history of New York there is reason for much optimism. The city’s whole raison d’être since its earliest days explains why.

The Puritans in New England, the Quakers in Pennsylvania, and the Catholics in Maryland first and foremost came to what would be the United States to find the freedom to worship God as they saw fit. The Dutch–who invented many aspects of modern capitalism and became immensely rich in the process–came to Manhattan to make money. And they didn’t much care who else came to do the same. Indeed, they were so busy trading beaver pelts they didn’t even get around to building a church for 17 years.

Twenty years after the Dutch arrived, the settlement at the end of Manhattan had only about a thousand inhabitants. But it was already so cosmopolitan that a French priest heard no fewer than 18 languages being spoken on its streets.

. . .

Deep within the heart of this vast metropolis–like the child within the adult–there is still to be found that little hustly-bustly, live-and-let-live, let’s-make-a-deal Dutch village. And the creation of wealth is still the city’s dearest love.

For the full commentary, see:

JOHN STEELE GORDON. “Opinion; Don’t Bet Against New York; The financial crisis has been devastating, but the city has reinvented itself many times before..” The Wall Street Journal (Sat., Sept. 19, 2009): A15.

(Note: ellipsis added.)