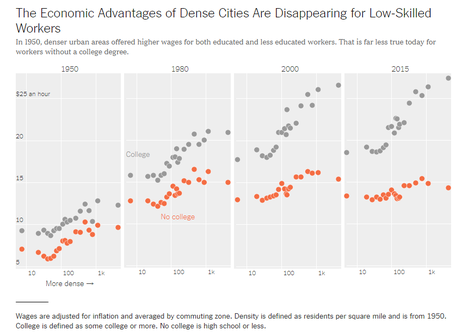

Source of graph: online version of the NYT article quoted and cited below.

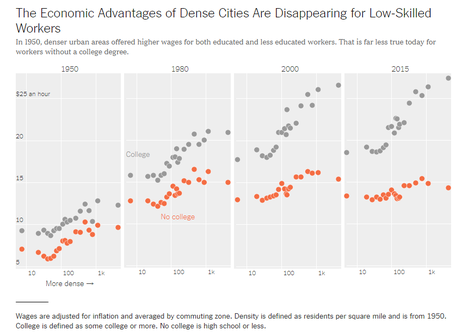

Source of graph: online version of the NYT article quoted and cited below.

I attended David Autor’s lecture at the early-January American Economic Association (AEA) meetings, that is discussed in the passages quoted below. It was an interesting, and sometimes almost exciting lecture. More than once he said something like: ‘now here’s something I wouldn’t have believed before 72 hours ago when we got these results.’

But it seemed very much a work in progress. In his lecture he accepts the polarization of the labor market has a current fact, even in cities. (“Polarization” roughly implies that high-level and low-level jobs are fine, but mid-level jobs are disappearing.)

In a 2015 paper, that I like very much, Autor argued that polarization is a temporary phenomenon that he did not expect to last. This 2015 paper was not mentioned in his Ely Lecture at the AEA.

(p. B1) “People have lamented, ‘Well, all these areas that lost manufacturing, why don’t those workers just get up and go somewhere else?'” said Mr. Autor, who looked at wage data from the census and American Community Survey and recently presented the findings at the annual meeting of the American Economic Association. “It’s just not at all obvious what that place is. It’s less obvious to me now than it was a month ago.”

Mr. Autor attributes the declining urban wage premium in this chart to the disappearance of “middle-skill jobs” in production but also in clerical, administrative and sales work. Many of these jobs have gone overseas. Others have been automated out of existence.

This kind of work, he argues, was historically clustered in cities (meaning the entire labor market around cities, within commuting zones). And because of that, workers with limited (p. B5) skills could find better opportunities by moving there.

Now, the urban jobs available to people with no college education — as servers, cleaners, security guards, home health aides — are basically the same kind as those available in smaller towns and rural communities.

For the full commentary, see:

Emily Badger and Quoctrung Bui. “The Upshot; Opportunity in Cities Falls to the Educated.” The New York Times (Saturday, Jan. 12, 2019): B1 & B5.

(Note: the online version of the commentary has the date Jan. 11, 2019, and has the title “The Upshot; What if Cities Are No Longer the Land of Opportunity for Low-Skilled Workers?”)

Autor’s 2015 paper, that I praise above, is:

Autor, David H. “Why Are There Still So Many Jobs? The History and Future of Workplace Automation.” Journal of Economic Perspectives 29, no. 3 (Summer 2015): 3-30.