Source of book image: http://www.inbubblewrap.com/2006/08/should_i_do_it_should_i.php

Source of book image: http://www.inbubblewrap.com/2006/08/should_i_do_it_should_i.php

According to Mr. Apgar, managing director of the Corporate Executive Board and a former McKinsey consultant, the problem is that our traditional tool set deals only with random risk. Equity prices, interest rates, natural catastrophes — all operate, more or less, as perfect markets, distributing risk with equal probability among all the players. No one consistently knows more about what drives these phenomena than anyone else. We can bear or hedge these risks in the secure sense that competitors don’t have an inside lead on the future.

. . .

In real business, though, many of the risks that can potentially wipe us out are non-random — what Mr. Apgar calls "learnable risks" — involving customers, technologies, marketing strategies, supplier relationships and so on. The challenge is not just to learn, quickly, enough about them to survive but to determine whether someone else can learn about them even faster and thus put us out of business.

. . .

. . . Mr. Apgar also explains how to perform a "risk audit," judging a company’s current projects by how they diversify total risk or demonstrate risk intelligence. Here is where his program differs most widely from conventional wisdom — because, as he notes, risk diversification is no virtue if the risks are non-random and we have little intelligence of any of them. If you don’t know much about poisonous snakes, keeping several different species won’t make you any safer.

Like liberty, risk intelligence demands eternal vigilance — and for the same reason: threats evolve. Mr. Apgar’s analysis of the life cycle of a business risk is particularly fruitful. He notes that a successful company needs to maintain a risk pipeline, constantly probing into areas where it has higher risk intelligence and opportunities for real diversification — just as technology and pharmaceutical companies need a proportion of blue-sky research to innovate into the future.

For the full review, see:

MICHAEL KAPLAN. "BOOKS; The Hazards of Fortune." Wall Street Journal (Fri., December 8, 2006): W6.

(Note: ellipses added.)

Source of graphic: online version of the WSJ article cited below.

Source of graphic: online version of the WSJ article cited below.

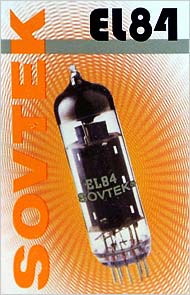

A vacuum tube used in guitar amplifiers, that was produced in the factory that Mike Matthews owned. Source of photo:

A vacuum tube used in guitar amplifiers, that was produced in the factory that Mike Matthews owned. Source of photo:  Source of image:

Source of image: