It is an enduring puzzle why the West has been so much more succesful than China in achieving economic growth over the past several centuries. The puzzle arises because there is considerable evidence of early Chinese acheivements in technology.

One example would be the exploratory voyages of Zheng He. The Chinese ships were much, much larger than those of Christopher Columbus. But as Clayton Christensen has shown in a more modern context, size does not always matter as much as nimbleness and motivation.

(And another part of the story involves culture and institutions.)

The most complete account of Christensen’s thinking, so far, is his book with Raynor:

Christensen, Clayton M., and Michael E. Raynor. The Innovator’s Solution: Creating and Sustaining Successful Growth. Boston, MA: Harvard Business School Press, 2003.

(Note: I am grateful to Prof. Yu-sheng Lin for first informing me of the large difference in size between the ships. I am also grateful to Prof. Salim Rashid, and Liberty Fund’s Mr. Leonidas Zelmanovitz, for my having the opportunity to encounter Prof. Lin.)

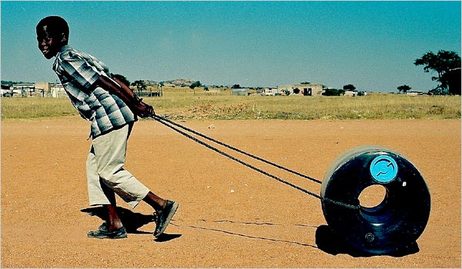

The photo on the left shows a woman safely drinking bacteria-laden water through a filter. The photo on the right shows a "pot-in-pot cooler" that evaporates water from wet sand between the pots, in order to cool what is in the inner pot. Source of photos: online version of the NYT article quoted and cited above.

The photo on the left shows a woman safely drinking bacteria-laden water through a filter. The photo on the right shows a "pot-in-pot cooler" that evaporates water from wet sand between the pots, in order to cool what is in the inner pot. Source of photos: online version of the NYT article quoted and cited above.