Source of book image: online version of the WSJ review quoted and cited below.

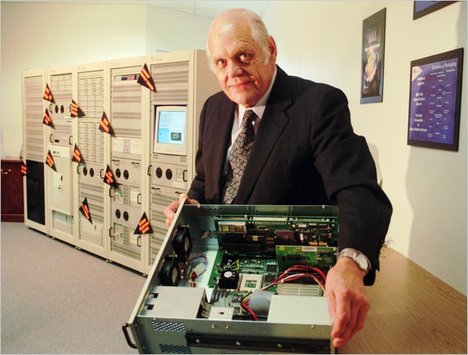

(p. A13) At the tail end of the 1990s dot-com boom, Douglas Edwards took a gamble: He left his marketing job at an old-media company, taking a $25,000 salary cut to start work at a small, little-known Internet concern in its second year of operation. That his new employer was losing money and burning through venture capital went without saying. But unlike the footloose 20-somethings who usually populated Silicon Valley start-ups, Mr. Edwards had little margin to bet wrong; he was 41, with a mortgage, three children and a worried wife. He hoped he could get his old job back if the company ran out of money.

. . .

Mr. Edwards came to his job as a subscriber to the conventional wisdom. In an early presentation to cofounder Larry Page and others, Mr. Edwards unwisely declared that only marketing, not technology, could set Google apart. “In a world where all search engines are equal,” he asserted, “we’ll need to rely on branding to differentiate us from our competitors.”

The room became quiet. Then Mr. Page spoke up. “If we can’t win on quality,” he said, “we shouldn’t win at all.”

For the full review, see:

DAVID A. PRICE. “BOOKSHELF; How Google Got Going; Branding, shmanding, a marketer was told. ‘If we can’t win on quality,’ Larry Page said, ‘we shouldn’t win at all.'” The Wall Street Journal (Tues., July 12, 2011): A13.

(Note: ellipsis added.)

Book being reviewed:

Edwards, Douglas. I’m Feeling Lucky: The Confessions of Google Employee Number 59. New York: Houghton Mifflin Harcourt Publishing Co., 2011.