Who makes the Apple iPod? Here’s a hint: It is not Apple. The company outsources the entire manufacture of the device to a number of Asian enterprises, among them Asustek, Inventec Appliances and Foxconn.

But this list of companies isn’t a satisfactory answer either: They only do final assembly. What about the 451 parts that go into the iPod? Where are they made and by whom?

Three researchers at the University of California, Irvine — Greg Linden, Kenneth L. Kraemer and Jason Dedrick — applied some investigative cost accounting to this question, using a report from Portelligent Inc. that examined all the parts that went into the iPod.

. . .

Continuing in this way, the researchers examined the major components of the iPod and tried to calculate the value added at different stages of the production process and then assigned that value added to the country where the value was created. This isn’t an easy task, but even based on their initial examination, it is quite clear that the largest share of the value added in the iPod goes to enterprises in the United States, particularly for units sold here.

The researchers estimated that $163 of the iPod’s $299 retail value in the United States was captured by American companies and workers, breaking it down to $75 for distribution and retail costs, $80 to Apple, and $8 to various domestic component makers. Japan contributed about $26 to the value added (mostly via the Toshiba disk drive), while Korea contributed less than $1.

. . .

The real value of the iPod doesn’t lie in its parts or even in putting those parts together. The bulk of the iPod’s value is in the conception and design of the iPod. That is why Apple gets $80 for each of these video iPods it sells, which is by far the largest piece of value added in the entire supply chain.

Those clever folks at Apple figured out how to combine 451 mostly generic parts into a valuable product. They may not make the iPod, but they created it. In the end, that’s what really matters.

For the full commentary, see:

The working paper that is the main source for Varian’s commentary, is:

The link is: http://pcic.merage.uci.edu/papers/2007/AppleiPod.pdf

Source of map: online version of the NYT article cited above.

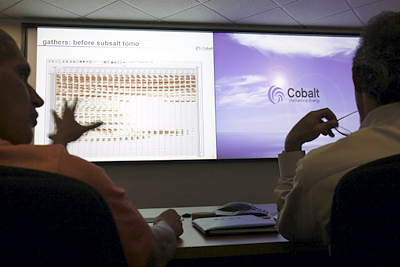

Source of map: online version of the NYT article cited above. "Cobalt scientists analyze data to help pinpoint oil deposits." Source of caption and photo: online version of the NYT article cited below.

"Cobalt scientists analyze data to help pinpoint oil deposits." Source of caption and photo: online version of the NYT article cited below. Wildcatter entrepreneur "Joseph H. Bryant started Cobalt." Source of caption and photo: online version of the NYT article cited above.

Wildcatter entrepreneur "Joseph H. Bryant started Cobalt." Source of caption and photo: online version of the NYT article cited above.

Yellowcake, which is processed uranium, is in the third jar from the left of the top photo. The photo below it is of old equipment at a dormant uranium mine. Source of the photos and the graphic: online version of the NYT article quoted and cited above.

Yellowcake, which is processed uranium, is in the third jar from the left of the top photo. The photo below it is of old equipment at a dormant uranium mine. Source of the photos and the graphic: online version of the NYT article quoted and cited above.