“”We hit the wall,” the 63-year-old grower says. . . . , Mr. Naumes showed off a Bosc pear.” Source of caption and photo: online version of the WSJ article quoted and cited below.

“”We hit the wall,” the 63-year-old grower says. . . . , Mr. Naumes showed off a Bosc pear.” Source of caption and photo: online version of the WSJ article quoted and cited below.

(p. A3) MEDFORD, Ore.–Farmers say conditions in southern Oregon’s Rogue River Valley are among the best in the world for raising pears. Yet for the past decade, acreage planted in pears has been halved, as has the number of growers.

Land-use regulations designed to maintain open space and preserve farmland are to blame, pear growers here say.

It is a paradox few foresaw in 1973, when Oregon passed Senate Bill 100. That measure, considered a landmark of the budding environmental movement, put Oregon on the map as the “greenest” of U.S. states by placing zoning decisions with a central agency, outside the purview of local authorities.

The law had a huge impact in restricting suburban sprawl throughout the state, preserving environmentally critical habitats.

But since the mid-1990s, more than 3,500 acres planted in pears have gone out of production here. From 87 pear farms operating in 1992, only 48 remain.

. . .

The credit crunch and consumers unwilling to splurge for $30 boxes of pears are behind much of the pain, growers say. Yet they insist their real headache is their inability to raise capital by selling land at top value, which they say would let them buy farmland further from residential areas. That is because land-use laws say their orchards must remain in agriculture.

“It’s the worst case of unintended consequences you can imagine,” says David D. Lowry, chief executive of Associated Fruit Co., the smallest of Medford’s Big Three, who fears his business could be the next to close. Like others, he has plenty of land to sell, but no one willing to buy as long as it is zoned for farming only.

For the full story, see:

JOEL MILLMAN. “Oregon Pear Growers Sour on Land Law; Farmers Say Landmark 1970s Measure Aimed at Conserving Agricultural Areas Limits Their Ability to Nurture Investment.” The Wall Street Journal (Fri., APRIL 2, 2010): A3.

(Note: ellipses added.)

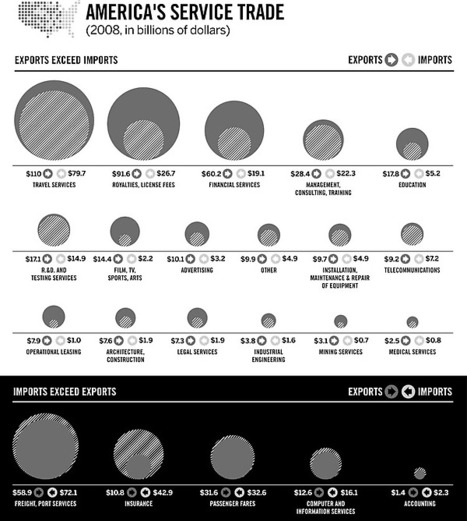

Source of graph: online version of the WSJ article quoted and cited above.