My Chicago professor Milton Friedman proposed educational vouchers in Capitalism and Freedom, a great book based on lectures that Friedman delivered several decades ago at Wabash College at the invitation of my first economics professor, Ben Rogge.

Friedman’s belief was that parents generally care about their children, and will seek a good education for them, if provided the means to choose among credible alternatives.

Special interests are arrayed against this idea, but that does not mean that Friedman was wrong.

Another distinguished educator who supports vouchers (see below) is Father Hesburgh, who for many years was President of Notre Dame in my hometown of South Bend, Indiana.

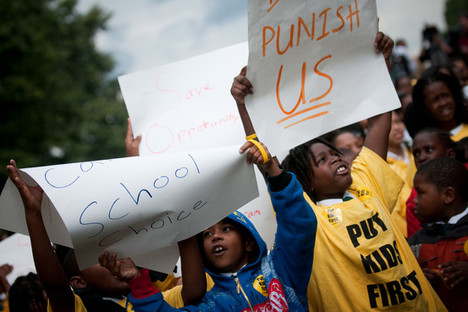

(p. A19) If Martin Luther King Jr. told me once, he told me a hundred times that the key to solving our country’s race problem is plain as day: Find decent schools for our kids. So I was especially heartened to hear Education Secretary Arne Duncan repeatedly call education the “civil rights issue of our generation.” Millions of our children–disproportionately poor and minority–remain trapped in failing public schools that condemn them to lives on the fringe of the American Dream.

. . .

. . . , I was deeply disappointed when Sen. Richard Durbin (D., Ill.) successfully inserted a provision in last year’s omnibus spending bill that ended one of the best efforts to give these struggling children the chance to attend a safe and decent school.

That effort is called the Opportunity Scholarship program. Since 2004 it has allowed thousands of children in Washington, D.C., to escape one of the worst public school systems in the nation by providing them with scholarships of up to $7,500.

Despite its successes, it is now closing down. On Tuesday the Senate voted against a measure introduced by Sen. Joseph Lieberman (I., Conn.) that would have extended the program. Throughout this process Mr. Duncan’s Education Department and the White House raised no protest.

. . .

I know that some consider voucher programs such as the Opportunity Scholarships a right-wing affair. I do not accept that label. This program was passed with the bipartisan support of a Republican president and Democratic mayor. The children it serves are neither Republican nor Democrat, liberal or conservative. They are the future of our nation, and they deserve better from our nation’s leaders.

I have devoted my life to equal opportunity for all Americans, regardless of skin color. I don’t pretend that this one program is the answer to all the injustices in our education system. But it is hard to see why a program that has proved successful shouldn’t have the support of our lawmakers. The end of Opportunity Scholarships represents more than the demise of a relatively small federal program. It will help write the end of more than a half-century of quality education at Catholic schools serving some of the most at-risk African-American children in the District.

I cannot believe that a Democratic administration will let this injustice stand.

For the full commentary, see:

THEODORE M. HESBURGH. “A Setback for Educational Civil Rights; I cannot believe that a Democratic administration will let this injustice of killing D.C. vouchers stand.” The Wall Street Journal (Thurs., MARCH 18, 2010): A19.

(Note: ellipses added.)

(Note: the online version of the article was dated MARCH 17, 2010.)

Reference to the Friedman book mentioned above:

Friedman, Milton. Capitalism and Freedom. Chicago: The University of Chicago Press, 1962.