Source of photo: http://www.nytimes.com/2006/07/27/world/middleeast/27mideast.html?pagewanted=2

Source of photo: http://www.nytimes.com/2006/07/27/world/middleeast/27mideast.html?pagewanted=2

The photo of Condi Rice touching her forehead ran on the top of the front page of the New York Times on Thurs., July 27, 2006. It ran big: filling over a third of the length of the paper, and over half of the width. It ran right next to the main headline of the front page: "CEASE-FIRE TALKS STALL AS FIGHTING RAGES ON 2 FRONTS."

It appears that Condi Rice is discouraged, or has a headache, or is overcome.

But a great CNN report by Jeanne Moos run on Sat., July 29, shows a dynamic version of the minute during which this snapshot was taken. It shows that this photo is a split-second moment of Condi Rice brushing hair off of her forehead.

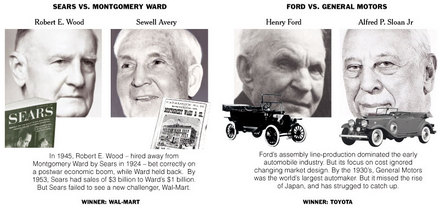

Our usual view of competition is to look at how many competitors there are at a moment in time. We look at a snapshot. But to really judge competition we must take Schumpeter seriously and look dynamically at whether there is the possibility of leapfrog competition over time.

In an earlier blog entry, I noted that Ronald Reagan resisted sitting for still photos because he thought that still photos could easily be manipulated to mislead. Ronald Reagan was right.

(Jeanne Moos’s report was entitled "Hairy Talks or Hair in Eyes?" on the CNN web site. I believe it first ran on 7/28/06, though I saw it replayed in the afternoon of 7/29/06.)

Charles Koch. Source of image: online version of WSJ article cited below.

Charles Koch. Source of image: online version of WSJ article cited below.

Gary Becker at April 7, 2006 tribute dinner. Source of image: online press release cited below.

Gary Becker at April 7, 2006 tribute dinner. Source of image: online press release cited below.