Erich Schneider had been a student of Schumpeter’s at the University of Bonn in the late 1920s. The following sentences are from his lectures on Schumpeter that he published in German in 1970, and that were were translated into English by W.E. Kuhn and published in that form in 1975.

(p. 41) When, after many years of separation, I saw Schumpeter again at Harvard in the fall of 1949 and heard his lectures on economic theory–which he gave at 2 p.m., as in Bonn–I found him to be exactly the same man as before. On that afternoon he talked about the nature of dynamic analysis and about the role of difference equations in the framework of such an analysis.

To the above passage, Schneider adds footnote 3:

(p. 59) He dropped the sarcastic remark: "There are economists who do not know what a difference equation is; but there are also those who know nothing else."

Schneider, Erich. Joseph A. Schumpeter: Leben Und Werk Eines Grossen Sozialokonomen (Life and Work of a Great Social Scientist). Lincoln, Neb.: University of Nebraska–Lincoln Bureau of Business Research, 1975.

Source of graphic: online version of WSJ article cited below.

Source of graphic: online version of WSJ article cited below.

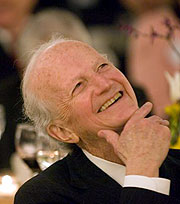

Gary Becker at April 7, 2006 tribute dinner. Source of image: online press release cited below.

Gary Becker at April 7, 2006 tribute dinner. Source of image: online press release cited below.