(p. A4) PARIS — On chilly winter mornings, most Parisians hurry by the now-locked square that is home to the beautiful medieval Tour St. Jacques. Only occasionally do they pause, perhaps hearing a light rustle on the fallen leaves or glimpsing something scampering among the dark green foliage.

A bird? A cat? A puppy?

No. A rat.

No. Three rats.

No. Look closer: Ten or 12 rats with lustrous gray-brown coats are shuffling among the dried autumn leaves.

Paris is facing its worst rat crisis in decades. Nine parks and green spaces have been closed either partly or entirely

. . .

In the 19th century, rats terrified and disgusted Parisians who knew that five centuries earlier, the creatures had brought the bubonic plague across the Mediterranean.

The plague ravaged the city, as it did much of Europe, killing an estimated 100,000 Parisians, between a third and half the population at the time. It recurred periodically for four more centuries. Not surprisingly, the experience left Paris with a millennium-long aversion to rodents.

. . .

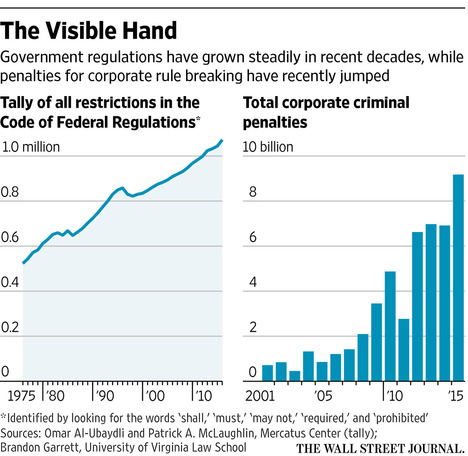

. . . why are they proliferating? Could it be everybody’s favorite scapegoat — the European Union and its faceless, unaccountable bureaucrats?

Yes, it could.

New regulations from Brussels, the European Union’s headquarters, have forced countries to change how they use rat poison, said Dr. Jean-Michel Michaux, a veterinarian and head of the Urban Animals Scientific and (p. A14) Technical Institute in Paris.

. . .

While the poison could be a risk to human beings, so are the rats — potentially, although no one is suggesting that the bubonic plague is likely to return.

For the full story, see:

ALISSA J. RUBIN. “PARIS JOURNAL; The Rats Came Back. Blame the E,U.” The New York Times (Fri., DEC. 16, 2016): A4 & A14.

(Note: ellipses added.)

(Note: the online version of the story has the date DEC. 15, 2016, and has the title “PARIS JOURNAL; Rodents Run Wild in Paris. Blame the European Union.”)