Some useful observations from the 2004 co-winner of the Nobel Prize in Economics, Edward Prescott:

Good tax rates, . . . , need be high enough to generate sufficient revenues, but not so high that they choke off growth and, perversely, decrease tax revenues. This, of course, is the tricky part, and brings us to the task at hand: Should Congress extend the 15% rate on capital gains and dividends? Wrong question. Should Congress make the 15% rate permanent? Yes. (This assumes that a lower rate is politically impossible.)

These taxes are particularly cumbersome because they hit a market economy right in its collective heart, which is its entrepreneurial and risk-taking spirit. What makes this country’s economy so vibrant is its participants’ willingness to take chances, innovate, acquire financing, hire new people and break old molds. Every increase in capital gains taxes and dividends is a direct tax on this vitality.

Americans aren’t risk-takers by nature any more than Germans are intrinsically less willing to work than Americans. The reason the U.S. economy is so much more vibrant than Germany’s is that people in each country are playing by different rules. But we shouldn’t take our vibrancy for granted. Tax rates matter. A shift back to higher rates will have negative consequences.

And this isn’t about giving tax breaks to the rich. The Wall Street Journal recently published a piece by former Secretary of Commerce Don Evans, who noted that “nearly 60% of those paying capital gains taxes earn less than $50,000 a year, and 85% of capital gains taxpayers earn less than $100,000.” In addition, he wrote that lower tax rates on savings and investment benefited 24 million families to the tune of about $950 on their 2004 taxes.

Do wealthier citizens realize greater savings? Of course — this is true by definition. But that doesn’t make it wrong. Let’s look at two examples: First, there are those entrepreneurs who have been working their tails off for years with little or no compensation and who, if they are lucky, finally realize a relatively big gain. What kind of Scrooge would snatch away this entrepreneurial carrot? As mentioned earlier, under a good system you have to provide for these rewards or you will discourage the risk taking that is the lifeblood of our economy. Additionally, those entrepreneurs create huge social surpluses in the form of new jobs and spin-off businesses. Entrepreneurs capture a small portion of the social surpluses that they create, but a small percentage of something big is, well, big.

Congratulations, I say. Another group of wealthier individuals includes those who, for a variety of reasons, earn more money than the rest of us. Again, I tip my hat. Does it make sense to try to capture more of those folks’ money by raising rates on everyone? To persecute the few, should we punish the many? We need to remember that many so-called wealthy families are those with two wage-earners who are doing nothing more than trying to raise their children and pursue their careers. Research has shown that much of America’s economic growth in recent decades is owing to this phenomenon — we should encourage this dynamic, not squelch it.

For the full commentary, see:

EDWARD C. PRESCOTT. “‘Stop Messing With Federal Tax Rates’.” The Wall Street Journal (Tues., December 20, 2005): A14.

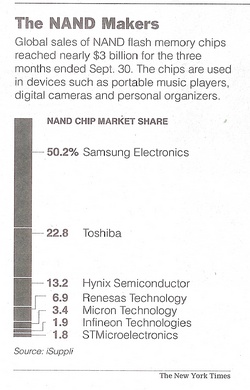

Source of table: online version of WSJ article cited below.

Source of table: online version of WSJ article cited below.

Source of book image: http://www.mikemilken.com/fincareer.taf?page=they_made_america

Source of book image: http://www.mikemilken.com/fincareer.taf?page=they_made_america