NEW DELHI, May 22 — The problem of caste prejudice here is as ancient as the Hindu texts. The efforts to redress it date from the formation of modern India nearly 59 years ago. Today — as India enjoys awesome rates of economic progress and confronts the challenge of spreading the benefits to its needy majority — the nation faces a polarizing totem of public policy: a government plan to extend college admission quotas to certain "backward" castes.

Affirmative action is in some ways an even more emotional issue in India than in the United States. In recent weeks, a proposal to extend quotas for admission to some of the country’s flagship, federally financed universities has caused fresh turmoil.

Protests — particularly by medical students who say merit should be the only basis for admission to India’s intensely competitive medical schools — have spread across the country and, here in the capital, hobbled public health services. Advocates and opponents of the measure have exchanged often ugly rants.

. . .

Medical students have been particularly outraged because the plan would further restrict the limited number of seats. Medical education in India begins with a five-year undergraduate program, and the proposal could affect students’ chances of completing their training.

The central lawn of the All India Institute of Medical Sciences, the pre-eminent public hospital, was occupied Friday by medical students on the fifth day of a strike that began last week and continued on Monday. "My merit is my caste. What is yours?" read one T-shirt.

. . .

The opponents say set-asides would diminish the quality of India’s best universities and divide students along caste lines.

"Why after 55 years are we still thinking in terms of caste-based reservation?" demanded Poojan Aggarwal, a third-year student at Safdarjung Medical College here. "We should talk now of total meritocracy. We know on this issue none of the political parties will support us."

For the full story, see:

(Note: ellipses added.)

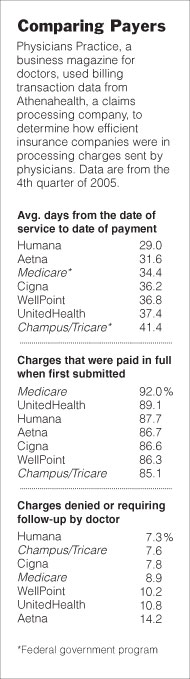

Source of graphic: online version of the WSJ article cited below.

Source of graphic: online version of the WSJ article cited below. Source of the graphic: the online version of the NYT article cited below.

Source of the graphic: the online version of the NYT article cited below.

Charles Koch. Source of image: online version of WSJ article cited below.

Charles Koch. Source of image: online version of WSJ article cited below.