“County Commissioner Rosaura Tijerina supported tax breaks for the Cedro Hill wind farm, but it brought few new jobs.” Source of caption and photo: online version of the WSJ review quoted and cited below.

“County Commissioner Rosaura Tijerina supported tax breaks for the Cedro Hill wind farm, but it brought few new jobs.” Source of caption and photo: online version of the WSJ review quoted and cited below.

(p. A1) Alfredo Garcia was among the residents of Webb County, Texas, banking on a windfall from federal stimulus money.

Mr. Garcia expanded his Mexican restaurant from 80 to 120 seats, anticipating a rush of new patrons springing from the nearby Cedro Hill wind farm, a project built with the help of $108 million from U.S. taxpayers.

When construction ended, Cedro Hill had just three employees and Mr. Garcia’s restaurant, Aimee’s, filed for bankruptcy protection. “Nobody came,” said Mr. Garcia, a county judge who closed Aimee’s last year, putting 18 people out of work.

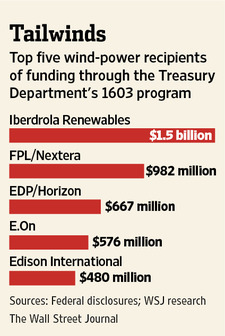

Companies have received more than $10 billion to create jobs and renewable energy by building wind farms, solar projects and other alternatives to oil and natural gas under section 1603 of the American Recovery and Reinvestment Act of 2009. The program expired in December, and President Barack Obama proposed last week that Congress revive it in the 2013 budget.

On federal applications, companies said they created more than 100,000 direct jobs at 1603-funded projects. But a Wall Street Journal investigation found evidence of far fewer. Some plants laid off workers. Others closed.

The discrepancies highlight broader challenges calculating the economic benefits of stimulus spending. Jobs have been an important measure influencing distribution of more than $800 billion in stimulus money, which also has included tax breaks and spending on roads, sewers, schools, health and public assis-(p. A10)tance. Yet the number of jobs created or saved is largely based on formulas, mathematical models and reports by recipients, rather than actual tallies.

For the full story, see:

IANTHE JEANNE DUGAN and JUSTIN SCHECK. “Cost of $10 Billion Stimulus Easier to Tally Than New Jobs.” The Wall Street Journal (Fri., FEBRUARY 24, 2012): A1 & A10.

Source of graphic: online version of the WSJ story quoted and cited above.

Such is the fate of capital-intensive industries. The same applied to the controversial Keystone XL pipeline. Claims of job creation and lower fuel prices were certainly overblown if one got down into the details; you don’t really need many employees to monitor gauges on a pipe line or a windfarm.

Of course, in the case of oil booms and the massive population explosions that result–such as in North Dakota–there are other problems. Ultimately in both cases slow and steady would be a better way to win the race.

That’s not to say that windfarms, oil refineries, and pipelines aren’t all noble pursuits (or at least useful pursuits), but that when government money is hinged on the idea of selling benefits (job growth), we get a distorted picture of the outcomes and people and resources get allocated inefficiently. And if the government isn’t distributing taxpayer money like so much candy at a ticker-tape parade, then the market can be allowed to work its magic and we can have these capital-intensive, life-improving projects without the shadow of cronyism.

And we can be truly honest about the benefits.