(p. A21) No country in the modern world has managed persistent economic growth without considerable reliance on private enterprise and decentralized private markets. All centrally planned economies failed to achieve sustained development, including the Soviet Union before its collapse, China before market reforms began in the late 1970s, and Cuba since Castro’s revolution in the late 1950s.

China’s private sector has led its dominance in textiles, electronics, and other consumer and producer goods. It’s followed the model of the “Asian Tigers”–Hong Kong, Singapore, South Korea and Taiwan–and relied heavily on exports produced with cheap labor. In the process, China has accumulated enormous reserves, as Taiwan, Japan and other rapidly growing Asian economies did in past decades.

Poorer countries like China need not get everything “right” to grow rapidly through exports to richer countries. They need only have some strong sectors that use world markets to fuel overall growth. Japan’s rapid growth from the 1960s-1980s was led by a highly efficient manufacturing sector. Yet at the same time Japan also had a large and inefficient service sector, and an agricultural sector that was riddled with subsidies and inefficient incentives.

Similarly, China’s economy still has a glut of state-owned enterprises (SOEs) with excessive employment and low productivity. Their importance has fallen over time, but Chinese economists estimate that they still control about half of nonagricultural GDP. One crucial example is the state-controlled financial sector that makes cheap loans to other large, inefficient and unprofitable state enterprises. China’s economy also suffers from extensive price controls, restrictions on migration, and many other structural barriers to efficient growth.

Category: China

Low End Tech Upstart Moves Up-Market to Compete with Incumbents

Source of graph: online version of the WSJ article quoted and cited below.

The MediaTek example briefly mentioned below, seems a promising fit with Christensen’s theory of disruptive innovators.

(p. B7) TAIPEI–A little-known Taiwanese chip-design company is making waves in the cellphone business, grabbing market share from larger U.S. rivals and helping drive down phone prices for consumers.

. . .

While MediaTek isn’t known for cutting-edge innovation, it has been able to apply the nimble, cost-cutting approach of Taiwan’s contract manufacturers to the business of designing semiconductors, in which engineers use advanced software to lay out the microscopic circuits that make gadgets like cellphones function.

“MediaTek has brought down the cost significantly,” says Jessica Chang, an analyst at Credit Suisse Group AG, who says mobile-phone makers are increasingly drawn to MediaTek’s products because of their functionality and low cost.

For the full story, see

TING-I TSAI. “Taiwan Chip Firm Shakes Up Cellphone Business.” The Wall Street Journal (Mon., APRIL 19, 2010): B7.

(Note: ellipsis added.)

On Christensen’s theories, see:

Christensen, Clayton M., and Michael E. Raynor. The Innovator’s Solution: Creating and Sustaining Successful Growth. Boston, MA: Harvard Business School Press, 2003.

China Exports to U.S. Are Smaller than Trade Stats Imply

Source of graph: online version of the WSJ article quoted and cited below.

(p. A2) The WTO says world trade fell 12.2% in 2009. On Friday, the organization predicted that trade would bounce back sharply this year, rising 9.5%.

But these figures don’t tell the whole truth about trade.

According to some economists, trade in finished products–the things consumers actually buy, such as cars, computers and iPods–declined by much less than 12.2% last year. That is because as much as two-thirds of the value of goods that go into trade statistics represent intermediate parts, which are imported from other countries and used to make finished products that then get re-exported. Economists call this the “valued-added effect.” If the value of imported parts were stripped out, however, global trade would have declined by between 4% and around 8% last year, economists say.

By ignoring the multinational composition of goods, conventional trade data also make trade imbalances between some trading partners seem larger than they really are.

China imports a huge quantity of parts from places like Japan and South Korea, but when those components are assembled into finished goods and shipped to the U.S., all the pieces count as Chinese exports, inflating the U.S. trade imbalance with its most polarizing trade partner.

A study by the Sloan Foundation in 2007, for example, found that only $4 of an iPod that costs $150 to produce is made in China, even though the final assembly and export occurs in China. The remaining $146 represents parts imported to China. If only the value added by manufacturers in China were counted, the real U.S.-China trade deficit would be as much as 30% lower than last year’s gap of at $226.8 billion, according to a number of economists.

At the same time, the U.S. trade deficit with Japan would have been 25% higher than the $44.8 billion reported last year, because many goods that China and others export to the U.S. contain parts purchased in Japan.

For the full story, see:

JOHN W. MILLER. “THE NUMBERS GUY; Some Say Trade Numbers Don’t Deliver the Goods .” The Wall Street Journal (Sat., MARCH 27, 2010): A2.

Entrepreneur Pleases Dwarfs; Critics Are Appalled

“Yang Jinlu, 18, left, and Zhang Yinghua, 37.” Source of caption and photo: online version of the NYT article quoted and cited below.

“Yang Jinlu, 18, left, and Zhang Yinghua, 37.” Source of caption and photo: online version of the NYT article quoted and cited below.

(p. A10) KUNMING, China — Chen Mingjing’s entrepreneurial instincts vaulted him from a peasant upbringing to undreamed-of wealth, acquired in ventures ranging from making electric meters to investing in real estate. But when he was 44, the allure of making money for money’s sake began to wane. He wanted to run a business that accomplished some good.

And so last September, Mr. Chen did what any socially aware entrepreneur might do: He opened a theme park of dwarfs, charging tourists about $9 a head to watch dozens of dwarfs in pink tutus perform a slapstick version of “Swan Lake” along with other skits.

Mr. Chen has big plans for his Kingdom of the Little People. Imagine a $115 million universe in miniature, set amid 13,000 acres of rolling hills and peaceful lakes in southern China’s Yunnan Province, with tiny dogs, tiny fruit trees, a 230-foot-high performance hall that looks like the stump of a prehistoric tree and standard-size guest cabins.

Also, a black BMW modified to resemble a flying saucer, from which dwarfs will spill forth to begin their performances.

“It will be like a fairy tale,” Mr. Chen said. “Everything here I have designed myself.”

. . .

Critics say displaying dwarfs is at best misguided and at worst immoral, a throwback to times when freak shows pandered to people’s morbid curiosity.

“Are they just going there to look at curious objects?” asked Yu Haibo, who leads a volunteer organization for the disabled in Jilin Province in the northeast.

“I think it is horrible,” said Gary Arnold, the spokesman for Little People of America Inc., a dwarfism support group based in California. “What is the difference between it and a zoo?” Even the term “dwarf” is offensive to some; his organization prefers “person of short stature.”

. . .

But there is another view, and Mr. Chen and some of his short-statured workers present it forcefully. One hundred permanently employed dwarfs, they contend, is better than 100 dwarfs scrounging for odd jobs. They insist that the audiences who see the dwarfs sing, dance and perform comic routines leave impressed by their skills and courage.

Many performers said they enjoyed being part of a community where everyone shares the same challenges, like the height of a sink. “Before, when we were at home, we didn’t know anyone our size. When we hang out together with normal-size people, we can not really do the same things,” said Wu Zhihong, 20. “So I really felt lonely sometimes.”

. . .

Supporters and critics agree on one point: the fact that the park is awash in job applications shows the disturbing dearth of opportunities for the disabled in China. Cao Yu, Mr. Chen’s assistant, says she receives three or four job inquiries a week.

“Under the current social situation in China, they really will not be able to find a better employment situation,” she said.

. . .

Mr. Chen said his employees had gained self-respect and self-sufficiency. “It doesn’t really matter to me what other people say,” he said. “The question is whether meeting me has changed their lives.”

For the full story, see:

SHARON LaFRANIERE. “Kunming Journal; A Miniature World Magnifies Dwarf Life.” The New York Times (Thurs., March 4, 2010): A10.

(Note: ellipses added.)

(Note: the online version of the article is dated March 3, 2010.)

“Workers relaxed in the dormitories.” Source of caption and photo: online version of the NYT article quoted and cited above.

“Workers relaxed in the dormitories.” Source of caption and photo: online version of the NYT article quoted and cited above.

Brin Plays Google’s “Ethical Trump Card”

“Co-founder Sergey Brin has been active in Google’s dealings with China.” Source of caption and photo: online version of the WSJ article quoted and cited below.

“Co-founder Sergey Brin has been active in Google’s dealings with China.” Source of caption and photo: online version of the WSJ article quoted and cited below.

(p. A8) As a boy growing up in the Soviet Union, Sergey Brin witnessed the consequences of censorship. Now the Google Inc. co-founder is drawing on that experience in shaping the company’s showdown with the Chinese government.

Mr. Brin has long been Google’s moral compass on China-related issues, say people familiar with the matter. He expressed the greatest concern among decision makers, they say, about the compromises Google made when it launched its Chinese-language search engine, Google.cn, in 2006. He is now the guiding force behind Google’s decision to stop filtering search results in China, say people familiar with the decision.

. . .

The move is the clearest manifestation yet of a tension that has always existed at Google.

The Internet company, on one hand, is analytical: It built its core search business on algorithms that determine the relevance of Web sites and has tried to apply quantitative analysis to traditionally subjective parts of a business, such as hiring decisions. On the other hand, Mr. Brin and co-founder Larry Page have passionately touted Google’s ability to spread democracy through access to information, and adopted the unofficial and now-famous motto, “Don’t Be Evil.”

“At its best, Google is data-driven with an ethical trump card,” said Larry Brilliant, who headed up the company’s philanthropic efforts until 2009. Always it was the founders, Messrs. Brin and Page, who could play that card, he added.

For the full story, see:

BEN WORTHEN. “Soviet-Born Brin Has Shaped Google’s Stand.” The Wall Street Journal (Sat., MARCH 13, 2010): A8.

(Note: ellipsis added.)

(Note: the online version of the article had the date MARCH 12, 2010 and has the slightly longer title “Soviet-Born Brin Has Shaped Google’s Stand on China.”)

Chinese Subsidies Create Unprofitable Overcapacity and Risk of Crisis

(p. 5) . . . subsidies, . . . , have spurred excess capacity and created a dangerous political dynamic in which these investments have to be propped up at all cost.

China has been building factories and production capacity in virtually every sector of its economy, but it’s not clear that the latest round of investments will be profitable anytime soon. Automobiles, steel, semiconductors, cement, aluminum and real estate all show signs of too much capacity. In Shanghai, the central business district appears to have high vacancy rates, yet building continues.

. . .

Over all, there is a lack of transparency. China’s statistics on its gross domestic product are based more on recorded production activity than on what is actually sold. Chinese fiscal and credit policies are geared toward jobs and political stability, and thus the authorities shy away from revealing which projects are most troubled or should be canceled.

Put all of this together and there is a very real possibility of trouble.

For the full commentary, see:

TYLER COWEN. “Economic View; Dangers of an Overheated China.” The New York Times, SundayBusiness Section (Sun., November 29, 2009 ): 5.

(Note: the online version of the commentary has the date November 28, 2009.)

(Note: ellipsis added.)

“How Am I Going to Live without Google?”

“A woman examined bouquets and messages left by Google users on Wednesday outside the Internet search company’s headquarters in Beijing.” Source of caption and photo: online version of the NYT article cited way below (after the citation to the quoted article, which is a different article).

“A woman examined bouquets and messages left by Google users on Wednesday outside the Internet search company’s headquarters in Beijing.” Source of caption and photo: online version of the NYT article cited way below (after the citation to the quoted article, which is a different article).

David Smick in The World as Curved, has suggested that restrictions on the internet in China, limit entrepreneurship, and ultimately economic growth.

(p. 5) BEIJING — At the elite Tsinghua University here, some students were joking Friday that they had better download all the Internet information they wanted now in case Google left the country.

But to many of the young, well-educated Chinese who are Google’s loyal users here, the company’s threat to leave is in fact no laughing matter. Interviews in Beijing’s downtown and university district indicated that many viewed the possible loss of Google’s maps, translation service, sketching software, access to scholarly papers and search function with real distress.

“How am I going to live without Google?” asked Wang Yuanyuan, a 29-year-old businessman, as he left a convenience store in Beijing’s business district.

. . .

Li An, a Tsinghua University senior, said she used to download episodes of “Desperate Housewives” and “Grey’s Anatomy” from sites run by BT China that are now closed. “I love American television series,” she said with frustration during a pause from studying Japanese at a university fast-food restaurant on Friday.

The loss of Google would hit her much harder, she said, because she relies on Google Scholar to download academic papers for her classes in polymer science. “For me, this is terrible,” Ms. Li said.

Some students contend that even after Google pulls out, Internet space will continue to shrink. Until now, Google has shielded Baidu by manning the front line in the censorship battle, said a 20-year-old computer science major at Tsinghua.

“Without Google, Baidu will be very easy to manipulate,” he said. “I don’t want to see this trend.”

A 21-year old civil engineering student predicted a strong reaction against the government. “If Google really leaves, people will feel the government has gone too far,” he insisted over lunch in the university cafe.

But asked whether that reaction would influence the government to soften its policies, he concentrated on his French fries. “I really don’t know,” he said.

For the full story, see:

SHARON LaFRANIERE. “Google Users in China, Mostly Young and Educated, Fear Losing Important Tool.” The New York Times, First Section (Sun., January 17, 2010): 5.

(Note: the online version of the article has the title “China at Odds With Future in Internet Fight” and is dated January 16, 2010.)

(Note: ellipsis added.)

The source of the photo at the top is the online version of:

KEITH BRADSHER and DAVID BARBOZA. “Google Is Not Alone in Discontent, But Its Threat Stands Out.” The New York Times (Thurs., January 13, 2010): B1 & B4.

(Note: the online version of the article has the slightly different title “Google Is Not Alone in Discontent, But Its Threat to Leave Stands Out” and is dated January 14, 2010.)

The reference to the Smick book is:

Smick, David M. The World Is Curved: Hidden Dangers to the Global Economy. New York: Portfolio Hardcover, 2008.

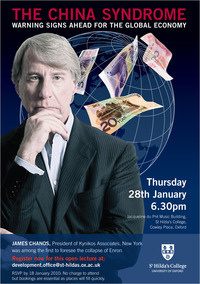

Chinese Economic Crisis Predicted by Investor Who Predicted Enron Collapse

“James Chanos made his hedge fund fortune predicting problems at companies and shorting their stock.” Source of caption and photo: online version of the NYT article quoted and cited below.

“James Chanos made his hedge fund fortune predicting problems at companies and shorting their stock.” Source of caption and photo: online version of the NYT article quoted and cited below.

Chanos’ views discussed below are plausible and worth taking seriously. Earlier and overlapping worries about the sustainability of China’s boom were expressed in a credible and scary book by David Smick called The World is Curved.

In addition to some of the concerns expressed by Chanos, Smick also emphasizes that China’s restrictions on the internet will dampen the ability of its entrepreneurs to succeed. That view seems prescient given China’s growing attempts to censor the internet and to hack Google.

(p. B1) SHANGHAI — James S. Chanos built one of the largest fortunes on Wall Street by foreseeing the collapse of Enron and other highflying companies whose stories were too good to be true.

Now Mr. Chanos, a wealthy hedge fund investor, is working to bust the myth of the biggest conglomerate of all: China Inc.

As most of the world bets on China to help lift the global economy out of recession, Mr. Chanos is warning that China’s hyperstimulated economy is headed for a crash, rather than the sustained boom that most economists predict. Its surging real estate sector, buoyed by a flood of speculative capital, looks like “Dubai times 1,000 — or worse,” he frets. He even suspects that Beijing is cooking its books, faking, among other things, its eye-popping growth rates of more than 8 percent.

“Bubbles are best identified by credit excesses, not valuation excesses,” he said in a recent appearance on CNBC. “And there’s no bigger credit excess than in China.” He is planning a speech later this month at the University of Oxford to drive home his point.

. . .

(p. B4) . . . he is tagging along with the bears, who see mounting evidence that China’s stimulus package and aggressive bank lending are creating artificial demand, raising the risk of a wave of nonperforming loans.

“In China, he seems to see the excesses, to the third and fourth power, that he’s been tilting against all these decades,” said Jim Grant, a longtime friend and the editor of Grant’s Interest Rate Observer, who is also bearish on China. “He homes in on the excesses of the markets and profits from them. That’s been his stock and trade.”

Mr. Chanos declined to be interviewed, citing his continuing research on China. But he has already been spreading the view that the China miracle is blinding investors to the risk that the country is producing far too much.

“The Chinese,” he warned in an interview in November with Politico.com, “are in danger of producing huge quantities of goods and products that they will be unable to sell.”

For the full story, see:

DAVID BARBOZA. “Shorting China: the Man Who Predicted Enron’s Fall Sees a Bigger Collapse Ahead.” The New York Times (Fri., January 8, 2010): B1 & B5.

(Note: the online version of the article has the title “Contrarian Investor Sees Economic Crash in China” and is dated January 7, 2010.)

(Note: ellipses added.)

The reference to the Smick book is:

Smick, David M. The World Is Curved: Hidden Dangers to the Global Economy. New York: Portfolio Hardcover, 2008.

“Now Mr. Chanos is betting against China, and is promoting his view that the China miracle has blinded investors to the risks in that economy.” Source of caption and poster: online version of the NYT article quoted and cited above.

“Market Wu” Annoys Maoists and Corrupt Bureaucrats

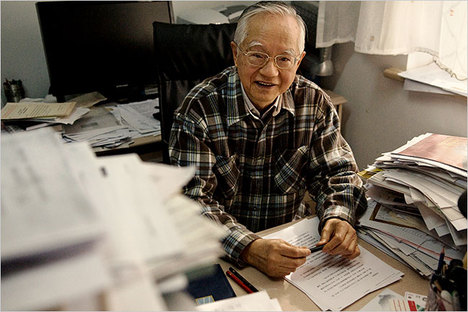

“Wu Jinglian helped to create China’s market economy, and now he is defending it against conservative hardliners in the Communist Party.” Source of caption and photo: online version of the NYT article quoted and cited below.

“Wu Jinglian helped to create China’s market economy, and now he is defending it against conservative hardliners in the Communist Party.” Source of caption and photo: online version of the NYT article quoted and cited below.

(p. 1) AT 79, Wu Jinglian is considered China’s most famous economist.

In the 1980s and ’90s, he was an adviser to China’s leaders, including Deng Xiaoping. He helped push through some of this country’s earliest market reforms, paving the way for China’s spectacular rise and earning him the nickname “Market Wu.”

Last year, China’s state-controlled media slapped him with a new moniker: spy.

Mr. Wu has not been interrogated, charged or imprisoned. But the fact that a state newspaper, The People’s Daily, among others, was allowed to publish Internet rumors alleging that he had been detained on suspicions of being a spy for the United States hints that he is annoying some very important people in the government.

He denied the allegations, and soon after they were published, China’s cabinet denied that an investigation was under way.

But in a country that often jails critics, Mr. Wu seems to be testing the limits of what Beijing deems permissible. While many economists argue that China’s growth model is flawed, rarely does a prominent Chinese figure, in the government or out, speak with such candor about flaws he sees in China’s leadership.

Mr. Wu — who still holds a research post at an institute affiliated with the State Council, China’s cabinet — has white hair and an amiable face, and he appears frail. But his assessments are often harsh. In books, speeches, interviews and television appearances, he warns that conservative hardliners in the Communist Party have gained influence in the government and are trying to dismantle the market reforms he helped formulate.

He complains that business tycoons and corrupt officials have hijacked the economy and manipulated it for their own ends, a system he calls crony capitalism. He has even called on Beijing to establish a British-style democracy, arguing that political reform is inevitable.

Provocative statements have made him a kind of dissident economist here, and revealed the sharp debates behind the scenes, at the highest levels of the Communist Party, about the direction of China’s half-market, half-socialist economy.

In many ways, it is a continuation of the debate that has been raging for three decades: What role should the government play in China’s hybrid economy?

Mr. Wu says the spy rumors were “dirty tricks” employed by his critics to discredit him.

“I have two enemies,” he said in a recent interview. “The crony capitalists and the Maoists. They will use any means to attack me.”

. . .

(p. 7) In interviews, Mr. Wu says he feels compelled to speak out because conservatives and “old-style Maoists” have been gaining influence in the government since 2004. These groups, he said, are pressing for a return to central planning and placing blame for corruption and social inequality on the very market reforms he championed.

At the same time, Mr. Wu says, corrupt bureaucrats are pushing for the state to take a larger economic role so they can cash in on their positions through payoffs and bribes, as well as by steering business to allies.

“I’m not optimistic about the future,” Mr. Wu said. “The Maoists want to go back to central planning and the cronies want to get richer.”

For the full story, see:

DAVID BARBOZA. “China’s Mr. Wu Keeps Talking.” The New York Times, SundayBusiness Section (Sun., September 26, 2009): 1 & 7.

(Note: ellipsis added.)

Source of timeline graphic: online version of the NYT article quoted and cited above.

Source of timeline graphic: online version of the NYT article quoted and cited above.

Obama Tire Tariff Hurts Poor

“A man walks past a tire store in Beijing on Sunday. A new U.S. tariff on Chinese tires could lead to shortages in the lower-cost-tire market segment as retailers scramble to find alternative sources in other countries.” Source of caption and photo: online version of the WSJ article quoted and cited below.

“A man walks past a tire store in Beijing on Sunday. A new U.S. tariff on Chinese tires could lead to shortages in the lower-cost-tire market segment as retailers scramble to find alternative sources in other countries.” Source of caption and photo: online version of the WSJ article quoted and cited below.

(p. A3) Consumers who buy low-price Chinese tires — the bulk of the tires China exports to the U.S. — will be hit hardest by the new tariff, as shortages in this market segment cause retailers to scramble to find alternative sources in other countries.

The tariffs, which apply to all Chinese tires, will cut off much of the flow of the more than 46 million Chinese tires that came to the U.S. last year, nearly 17% of all tires sold in the country.

The low end of the market will feel the impact of the tariff most, as U.S. manufacturers, who joined the Chinese in opposing the tariffs, have said it isn’t profitable to produce inexpensive tires in domestic plants.

“I think within the next 60 days you’ll see some pretty significant price increases,” said Jim Mayfield, president of Del-Nat Tire Corp. of Memphis, Tenn., a large importer and distributor of Chinese tires. He estimates prices for “entry-level” tires could increase 20% to 30%.

For the full story, see:

TIMOTHY AEPPEL. “Tariff on Tires to Cost Consumers; Higher Prices Expected at Market’s Low End, Where China Focuses Its Exports.” The Wall Street Journal (Mon., SEPTEMBER 14, 2009): A3.

(Note: the online version of the article has the date Tues., Sept. 15.)