George Gilder emphasizes that the importance of entrepreneurship to economic growth has been missed by many economists, in part because of the difficulty of measuring both the inputs of entrepreneurship (e.g., courage, persistence, creativity, etc.) and the outputs of entrepreneurship (e.g., happiness from more challenging work, greater variety of products, etc.).

Unfortunately this is not just an academic problem, because economists’ policy advice is based on their models, and their models focus on what they can measure. If they can’t measure entrepreneurship, then policies to encourage entrepreneurship are neglected.

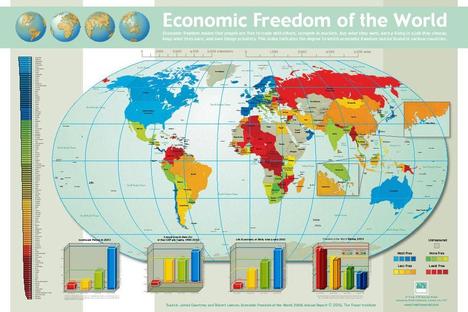

Now the Frazer Institute, is seeking proposals to improve the measurement of important poorly measured policy-relevant variables. This initiative is in the spirit of the good work that the Frazer Institute has done in correlating measures of economic freedom with measures of economic growth.

I have been asked to publicize this initiative, and am pleased to do so:

Dear Art Diamond,

The Fraser Institute is launching a new contest to identify economic and public policy issues which still require proper measurement in order to facilitate meaningful analysis and public discourse. We hope you can help promote this contest by posting it on your weblog, artdiamondblog.

The Essay Contest for Excellence in the Pursuit of Measurement is an opportunity for the public to comment on an economic or public policy issue that they feel is important and deserves to be properly measured.

A top prize of $1,000 and other cash prizes can be won by identifying a vital issue that is either not being measured, or is being measured inappropriately. Acceptable entry formats include a short 500-600 word essay, or a short one-minute video essay.

Complete details and a promotional flyer are available at: http://www.fraserinstitute.org/programsandinitiatives/measurement_center.htm.

Entry deadline is Friday, May 15th, 2009.

Sponsored by the R.J. Addington Center for the Study of Measurement.

Enquiries may be directed to:

Courtenay Vermeulen

Education Programs Assistant

The Fraser Institute

Direct: 604.714.4533

courtenay.vermeulen@fraserinstitute.org

The Fraser Institute is an independent international research and educational organization with offices in Canada and the United States and active research ties with similar independent organizations in more than 70 countries around the world. Our vision is a free and prosperous world where individuals benefit from greater choice, competitive markets, and personal responsibility. Our mission is to measure, study, and communicate the impact of competitive markets and government interventions on the welfare of individuals.

An important source of Gilder’s views, obliquely referred to in my comments above, is:

Gilder, George. Recapturing the Spirit of Enterprise: Updated for the 1990s. updated ed. New York: ICS Press, 1992.