The story below is very reminiscent of a story that Michael Lewis tells in The New, New Thing about how entrepreneur Jim Clark learned to fly.

Possible lesson: impatience and quick learning may not be traits of all high level entrepreneurs, but they appear to have been traits of at least two.

(p. 213) Seventeen years later, Broggie told Richard Hubler that teaching Disney how to run a lathe and drill press and other machinery was difficult “because he was impatient. So I’d make what we call a set-up in a lathe and turn out a piece and say, ‘Well, that’s how you do it.’ He would see part of it and he was impatient, so he would want to turn the wheels–and then something would happen. A piece might fly out of the chuck and he’d say, ‘God-damn it. why didn’t you tell me it was going to do this?’ Well, you don’t tell him, you know? It was a thing of–well–you learn it. He said one day, . . . ‘You know, it does me some good sometimes to come down here to find out I don’t know all about everything.’ . . . How would you sharpen the drill if it was going to drill brass or steel? There’s a difference. And he learned it. You only had to show him once and he got the picture.”

This was a characteristic that other people in the studio noticed. “He had a terrific memory,” Marc Davis said. “He learned very quickly. . . . You only had to explain a thing once to him and he knew how to do it. Other people are not the same. I think this is a problem he had in respect to everybody . . . his tremendous memory and his tremendous capacity for learning. He wasn’t book learned but he was the most fantastically well educated man in his own way. . . . He understood the mechanics of everything. . . . Everything was a new toy. And this also made him a very impatient man. He was as impatient as could be with whoever he worked with.”

Disney’s lack of formal education manifested itself sometimes in jibes at his college-educated employees, but more often in the odd lapses–the mispronounced words, the grammatical slips–that can mark an autodidact. “For a guy who only went to the eighth grade,” Ollie Johnston said, “Walt educated himself beautifully. His vocabulary was good. I only heard him get sore (p. 214) about a big word once in a story meeting. Everyone was sitting around talking and Ted Sears said, ‘Well, I think that’s a little too strident.’ Walt said, ‘What the hell are you trying to say, Ted?’ He hadn’t heard that word before.

Source:

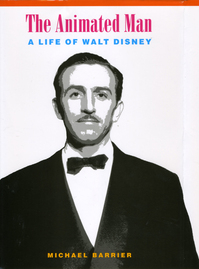

Barrier, Michael. The Animated Man: A Life of Walt Disney. 1 ed. Berkeley, CA: University of California Press, 2007.

(Note: ellipses in original.)

For a similar story about Jim Clark, see:

Lewis, Michael. The New New Thing: A Silicon Valley Story. New York: W. W. Norton & Company, 2000.