(p. 236) What redeemed the life of a rice farmer, however, was the nature of that work. It was a lot like the garment work done by the Jewish immigrants to New York. It was meaningful. First of all, there is a clear relationship in rice farming between effort and reward. The harder you work a rice field, the more it yields. Second, it’s complex work. The rice farmer isn’t simply planting in the spring and harvesting in the fall. He or she effectively runs a small business, juggling a family workforce, hedging uncertainty through seed selection, building and managing a sophisticated irrigation system, and coordinating the complicated process of harvesting the first crop while simultaneously preparing the second crop.

And, most of all, it’s autonomous. The peasants of Europe worked essentially as low-paid slaves of an aristocratic landlord, with little control over their own destinies. But China and Japan never developed that kind of oppressive feudal system, because feudalism simply can’t work in a rice economy. Growing rice is too complicated and intricate for a system that requires farmers to be coerced and bullied into going out into the fields each morning. By the fourteenth and fifteenth centuries, landlords in central and Southern China had an almost completely hands-off relationship with their tenants: they would collect a fixed rent and let farmers go about their business.

“The thing about wet-rice farming is, not only do you (p. 237) need phenomenal amounts of labor, but it’s very exacting,” says the historian Kenneth Pomerantz. “You have to care. It really matters that the field is perfectly leveled before you flood it. Getting it close to level but not quite right makes a big difference in terms of your yield. It really matters that the water is in the fields for just the right amount of time. There’s a big difference between lining up the seedlings at exactly the right distance and doing it sloppily. It’s not like you put the corn in the ground in mid-March and as long as rain comes by the end of the month, you’re okay. You’re controlling all the inputs in a very direct way. And when you have something that requires that much care, the overlord has to have a system that gives the actual laborer some set of incentives, where if the harvest comes out well, the farmer gets a bigger share. That’s why you get fixed rents, where the landlord says, I get twenty bushels, regardless of the harvest, and if it’s really good, you get the extra. It’s a crop that doesn’t do very well with something like slavery or wage labor. It would just be too easy to leave the gate that controls the irrigation water open a few seconds too long and there goes your field.”

Source:

Gladwell, Malcolm. Outliers: The Story of Success. New York, NY: Little, Brown, and Co., 2008.

(Note: italics in original.)

Source of table: "World Publics Welcome Global Trade — But Not Immigration." Pew Global Attitudes Project, a project of the PewResearchCenter. Released: 10.04.07 dowloaded from:

Source of table: "World Publics Welcome Global Trade — But Not Immigration." Pew Global Attitudes Project, a project of the PewResearchCenter. Released: 10.04.07 dowloaded from:

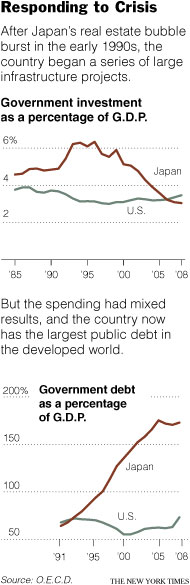

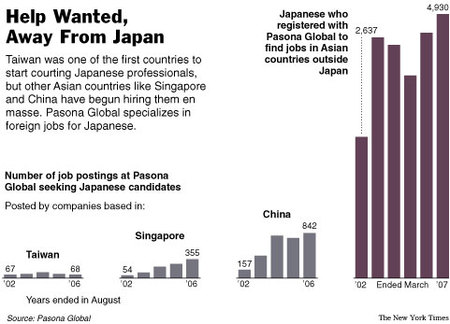

Source of graphic: online version of the NYT article cited below.

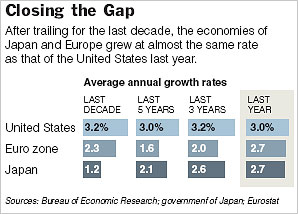

Source of graphic: online version of the NYT article cited below.  Source of graph: online version of WSJ article cited below.

Source of graph: online version of WSJ article cited below.