(p. A1) LULEA, Sweden — Lotta Landström is allergic to electricity — so says her doctor. Along with hundreds of other Swedes diagnosed with the condition in recent years, she came to rely on state-funded sick pay.

But last year, Sweden’s famously generous welfare system cut off Ms. Landström, a 35-year-old former teacher. Electro-hypersensitivity isn’t widely recognized elsewhere in the world as a medical diagnosis. The decision to end her two years of benefits was part of a broad effort to crack down on sickness and disability benefits, according to Swedish welfare officials.

Swedes are among the healthiest people in the world according to the World Health Organization. And yet 13% of working-age Swedes live on some type of disability benefit — the highest proportion on the globe. To explain this, many Swedish policy makers, doctors and economists blame a welfare system that is too lax and does little to verify individual claims.

At a time when low-cost competition from Asia is clobbering Europe’s markets and straining its generous welfare states, governments from Finland to Portugal are trying to cut back and get more people to work. Sweden’s bloated sick bay, which includes (p. A15) roughly 744,000 people on extended leave, has caused soul-searching about whether the system coddles Swedes and encourages them to feel sick.

"If we don’t look out, we will end up with only two-thirds [of the labor force] in work, and one-third out, living on different kinds of subsidies," said Sweden’s new prime minister, Fredrik Reinfeldt, in an interview earlier this year.

At a time when low-cost competition from Asia is clobbering Europe’s markets and straining its generous welfare states, governments from Finland to Portugal are trying to cut back and get more people to work. Sweden’s bloated sick bay, which includes roughly 744,000 people on extended leave, has caused soul-searching about whether the system coddles Swedes and encourages them to feel sick.

"If we don’t look out, we will end up with only two-thirds [of the labor force] in work, and one-third out, living on different kinds of subsidies," said Sweden’s new prime minister, Fredrik Reinfeldt, in an interview earlier this year.

. . .

Most of Sweden’s boom in sickness absenteeism since the late 1990s is about more than simple fraud. Sick leave for psychological conditions such as depression, burnout or panic attacks has rocketed. Over 20% of the population complain of anxiety syndromes. "We are actually the safest country in the world," says David Eberhard, chief psychiatrist at St. Göran’s hospital in Stockholm. But "people are feeling psychologically worse and worse."

Assar Lindbeck, one of Sweden’s best-known economists, says the lenient welfare state has changed the country over the past generation. In place of the old Protestant work ethic, it has become acceptable to feel unable to work and to live on benefits, he says. "I would not call it cheating," Prof. Lindbeck says. "I would call it a drift in attitudes and social norms."

By being so accommodating, the Swedish system has encouraged Swedes to treat life’s tribulations as clinical issues requiring sick leave, posits Anna Hedborg, a former Social Democrat cabinet minister: "As time has passed, we have medicalized all sorts of problems."

Source of graphic: online version of the WSJ article excerpted and cited below.

Source of graphic: online version of the WSJ article excerpted and cited below.

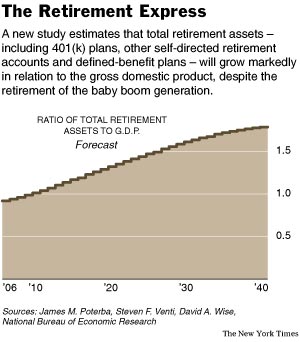

Source of graph: online version of the NYT article cited below.

Source of graph: online version of the NYT article cited below.

Source of graphic: online version of the WSJ article cited below.

Source of graphic: online version of the WSJ article cited below. A former Swedish teacher who had been receiving government disability payments for being allergic to electricity. Source of photo: online version of the WSJ article cited above.

A former Swedish teacher who had been receiving government disability payments for being allergic to electricity. Source of photo: online version of the WSJ article cited above.