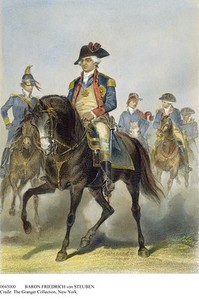

“German soldier of fortune and American ally Baron von Steuben (1730-94)” Source of caption and photo: online version of the WSJ review quoted and cited below.

(p. W9) The essence of Steuben’s achievement was his modification of the brutal, robotic precision of the Prussian system to fit American conditions. He was able to do this because he was one of the first foreign observers, military or civilian, to grasp an essential strain of the American character. “The genius of this nation,” he wrote a European friend, “is not in the least to be compared with that of the Prussians, Austrians or French. You say to your soldier, ‘Do this,’ and he doeth it. I am obliged to say, ‘This is the reason why you ought to do that,’ and then he does it.”

. . .

While Mr. Lockhart tends to soft-pedal some of Steuben’s more dubious deeds — ignoring, for instance, his attempt to interest Prince Henry of Prussia, Frederick the Great’s younger brother, in becoming king of the independent colonies before the adoption of the Constitution — the author generally treats his subject with balance, understanding and great good humor, aptly concluding that, “although he blurred a few details of the past in order to seek preferment in the United States, somewhere between his arrival and the achievement of American independence, the Baron became something very much like the man he had pretended to be.”

For the full review, see:

ARAM BAKSHIAN JR. “BOOKS; Revolutionary Scamp.” The Wall Street Journal (Sat., NOVEMBER 8, 2008): W9.

The reference to the book under review is:

Lockhart, Paul. The Drillmaster of Valley Forge. New York: HarperCollins Publishers, 2008.

Source of book image: http://robertos-book-picks.blogspot.com/2008/11/drillmaster-of-valley-forge-baron-de.html