Source of image: online version of the WSJ article cited below.

Source of image: online version of the WSJ article cited below.

A new United Nations report called "State of the Future" concludes: "People around the world are becoming healthier, wealthier, better educated, more peaceful, more connected, and they are living longer."

. . .

To what do we owe this improvement? Capitalism, according to the U.N. Free trade is rightly recognized as the engine of global prosperity in recent years. In 1981, 40% of the world’s population lived on less than $1 a day. Now that percentage is only 25%, adjusted for inflation. And at current rates of growth, "world poverty will be cut in half between 2000 and 2015" — which is arguably one of the greatest triumphs in human history. Trade and technology are closing the global "digital divide," and the report notes hopefully that soon laptop computers will cost $100 and almost every schoolchild will be a mouse click away from the Internet (and, regrettably, those interminable computer games).

It also turns out that the Malthusians (who worried that we would overpopulate the planet) got the story wrong. Human beings aren’t reproducing like Norwegian field mice. Demographers now say that in the second half of this century, the human population will stabilize and then fall. If we use the same absurd extrapolation techniques demographers used in the 1970s, Japan, with its current low birth rate, will have only a few thousand citizens left in 300 years.

I take special pleasure in reciting all of this global betterment because my first professional job was working with the "doom-slaying" economist Julian Simon. Starting 30 years ago, Simon (who died in 1998) told anyone who would listen — which wasn’t many people — that the faddish declinism of that era was bunk. He called the "Global 2000" report "globaloney." Armed with an arsenal of factual missiles, he showed that life on Earth was getting better, and that the combination of free markets and human ingenuity was the recipe for solving environmental and economic problems. Mr. Ehrlich, in response, said Simon proved that the one thing the world isn’t running out of "is lunatics."

Mr. Ehrlich, whose every prediction turned out wrong, won a MacArthur Foundation "genius award"; Simon, who got the story right, never won so much as a McDonald’s hamburger. But now who looks like the lunatic? This latest survey of the planet is certainly sweet vindication of Simon and others, like Herman Kahn, who in the 1970s dared challenge the "settled science." (Are you listening, global-warming alarmists?)

The media’s collective yawn over "State of the Future" is typical of the reaction to just about any good news. When 2006 was declared the hottest year on record, there were thousands of news stories. But last month’s revised data, indicating that 1934 was actually warmer, barely warranted a paragraph-long correction in most papers.

For the full commentary, see:

(Note: ellipsis added.)

Source of graph: online version of the NYT article cited below.

Source of graph: online version of the NYT article cited below.

Source of table: online version of the WSJ article cited below.

Source of table: online version of the WSJ article cited below.

The Korean immigrant owners of the dry cleaners who were being sued for $67.3 million dollars. Source of the photo: online version of the NYT article cited below.

The Korean immigrant owners of the dry cleaners who were being sued for $67.3 million dollars. Source of the photo: online version of the NYT article cited below.

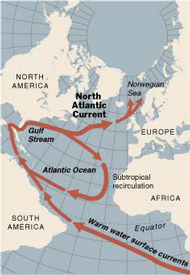

Source of the map: online version of the NYT article quoted and cited above.

Source of the map: online version of the NYT article quoted and cited above.