(p. 17) Linda Fisch stopped at the A.&P. on Riverdale Avenue in the Bronx on Thursday and bought eight prepackaged containers of cottage cheese and fruit. She did not realize the store had become a footnote to history.

That A.&P. is the last in New York City, where the once-mighty chain was born just before the Civil War. Now the company has filed for bankruptcy protection for the second time in five years. Once its plan for liquidating is approved, the store’s A.&P. signs will come down. And the A.&P. name will vanish from New York.

. . .

Once, A.&P. had no competition. It all but invented the grocery store in the 19th century, and in the 20th century, it reinvented itself as a low-price, cash-and-carry chain. Its thousands of stores were “so devoid of frills that they are simply machines for selling food,” according to “The Great Merchants,” a history of retailers and retailing published in 1974.

But it had been fading for years. In the mid-1980s, a former A.&P. executive published a book “The Rise and Decline of the Great Atlantic & Pacific Tea Company” even as A.&P. continued to expand, buying Waldbaum’s and the Food Emporium chain in New York City and the Farmer Jack chain in the Midwest. A.&P. acquired Pathmark in 2007 for $679 million in a deal that involved significant debt. It also operated Super Fresh and Food Basics stores.

. . .

It began as a sideline for a hide and leather importer, George H. Gilman. “At some point around 1859 or 1860, there’s no precise date, he started selling tea,” said Marc Levinson, a historian and the author of “The Great A.&P. and the Struggle for Small Business in America.” “In 1860 or 1861, he gave up on the leather business, gave it to his brother, and decided to go into business as a tea wholesaler. He leased a property on Front Street. It’s the area where most of the ships carrying tea would come in.”

Mr. Levinson said a Gilman employee, George Huntington Hartford, became involved in the new business. Some accounts say it was Hartford who proposed eliminating middlemen — and cutting prices to consumers. From its earliest years, the little tea company promised in advertisements, it would “do away with various profits and brokerages, cartages, storages, cooperage and waste, with the exception of a small commission paid for purchasing to our correspondents in Japan and China.”

. . .

“I grew up on Long Island and the A.&P. was the only supermarket in the town I grew up in, which was Lynbrook,” said Ms. Fisch, 71. “Of course that’s where we shopped. It was bright and it was clean, which is totally different from the one in Riverdale. It’s like it’s been going out of business for a long time.”

For the full story, see:

JAMES BARRON. “A.& P. Bankruptcy Means New York, Chain’s Birthplace, Will Lose Last Store.” The New York Times, First Section (Sun., AUG. 2, 2015): 17.

(Note: ellipses added.)

(Note: the online version of the story has the date AUG. 1, 2015.)

The first book mentioned above, is:

Mahoney, Tom, and Leonard Sloane. The Great Merchants: America’s Foremost Retail Institutions and the People Who Made Them Great. Updated and Enlarged ed. New York: Harper & Row, 1974.

The second book mentioned above, is:

Walsh, William I. The Rise and Decline of the Great Atlantic & Pacific Tea Company. Secaucas, N.J.: Lyle Stuart, 1986.

Levinson’s great book, mentioned above, is:

Levinson, Marc. The Great A&P and the Struggle for Small Business in America. New York: Hill and Wang, 2011.

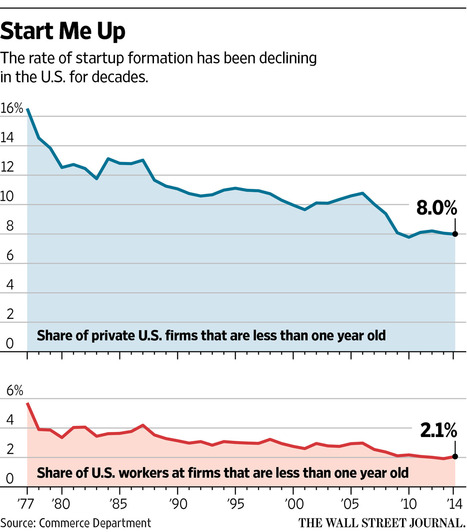

Source of graph: online version of the WSJ article quoted and cited below.

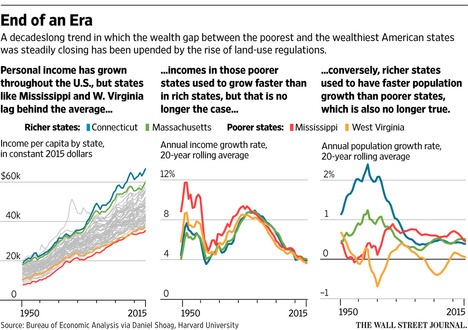

Source of graph: online version of the WSJ article quoted and cited below.