Andrew Jackson was the first in a long line of populist Democratic presidents:

(p. 24) He relished the roles of protector and savior. Just after dusk on a cold March day in 1791, when Jackson was practicing law on the circuit around Jonesborough, Tennessee, he and his friend John Overton were traveling with a small group through dangerous territory. Reaching the banks of the Emory River in the mountains, the lawyers spotted a potentially hostile Indian party. “The light of their fires showed that they were numerous,” Overton recalled to Henry Lee, and “that they were painted and equipped for war.” Under Jackson’s leadership (Overton credited him with a “saving spirit and elastic mind”), the travelers scrambled into the hills on horseback, riding roughly parallel to the river–which they had to cross to make it home. Pursued by the Indians, Jackson, Overton, and two others pressed on through the night, coming to a place where the water looked smooth enough to allow a hastily constructed raft and the horses to make it to the other side. Jackson look charge of the raft piled high with saddles and clothes. Overton would follow with the horses.

There was immediate trouble. The waters were not as smooth as they had appeared; a powerful undercurrent swept the boat–and Jackson– downstream, toward a steep waterfall. “Overton and his companion instantly cried out and implored Jackson to pull back,” Lee wrote. But he either not being so sensible of the danger, or being unwilling to yield to it, (p. 25) continued to push vigorously forward.” Jackson struggled with his oars; disaster was at hand. He and the saddles could he lost, and the Indians were still on their trail. “Finding himself just on the brink of the awful precipice,” Lee recounted, Jackson extended his oar to Overton, who “laid hold of it and pulled the raft ashore, just as it was entering the suck of the torrent.” Catching their breath on the bank of the river, Overton and Jackson looked at each other.

“You were within an ace, Sir, of being dashed to pieces,” Overton told him. Jackson waved him off, replying, “A miss is as good as a mile; it only shows how close I can graze danger. But we have no time to lose–follow me and I’ll save you yet.” They eluded the Indians, arriving home exhausted but safe.

Source:

Meacham, Jon. American Lion: Andrew Jackson in the White House. New York: Random House, 2008.

(Note: the semi-colons in the above passage were hard to distinguish, in the online version, from colons. I judged them to be semi-colons from context, but I could be wrong.)

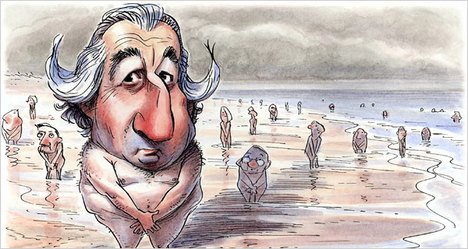

Bernie Medoff, and friends, swimming naked. Source of caricature: online version of the NYT article quoted and cited below.

Bernie Medoff, and friends, swimming naked. Source of caricature: online version of the NYT article quoted and cited below.